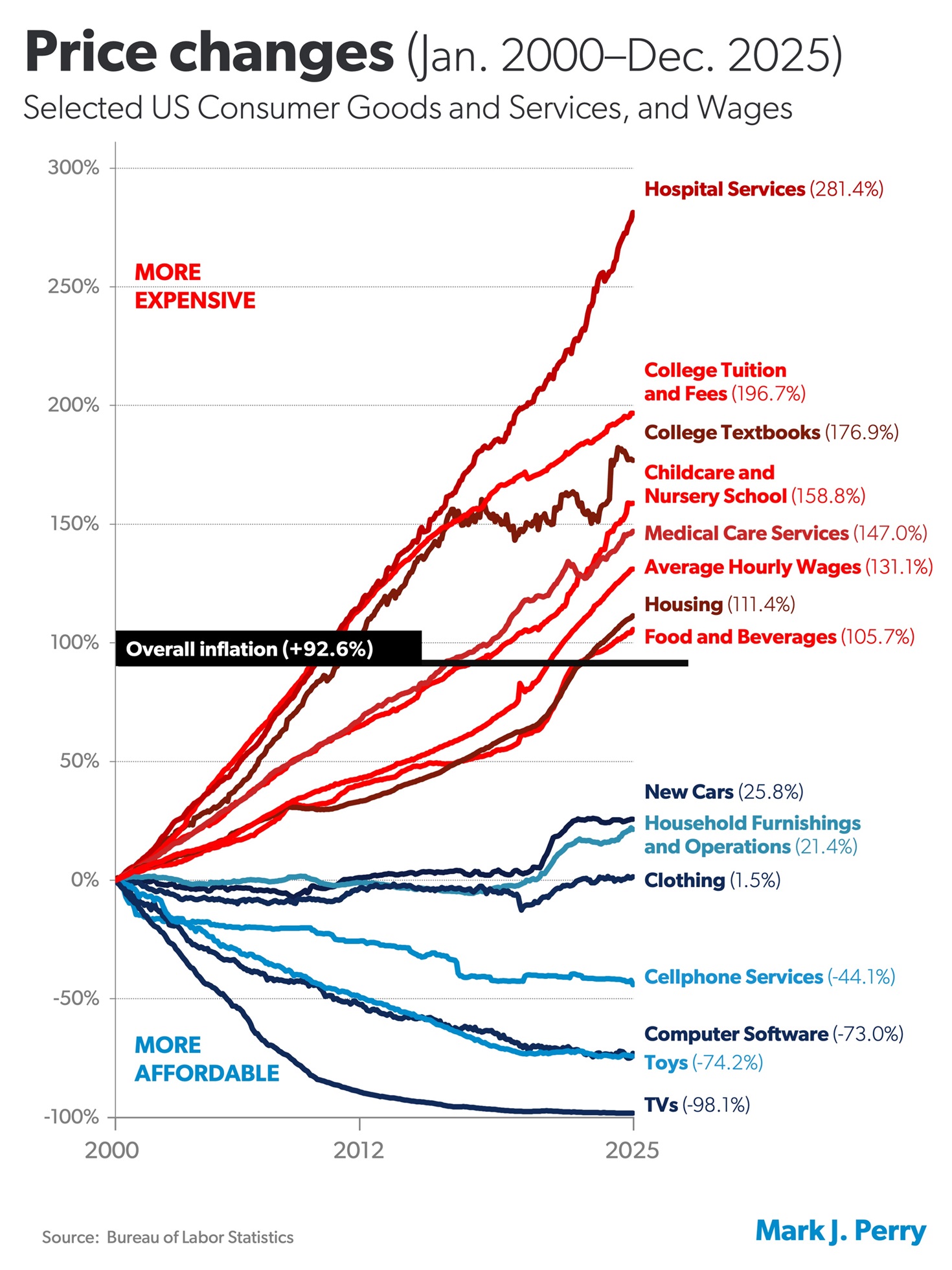

If you’re feeling the pinch every time you hit the doctor, send a kid to college, or hunt for a house, you’re not alone. This chart from the Bureau of Labor Statistics, crunched by economist Mark Perry, lays it out bare: from January 2000 to December 2025, prices for essentials have gone berserk in sectors where Uncle Sam’s meddling is deepest, while free-market goodies like TVs and gadgets have plummeted.

Overall inflation clocked in at 92.6 percent over those 25 years, but look at the red lines shooting up like rockets – hospital services up 281.4 percent, college tuition and fees at 196.7 percent, textbooks 176.9 percent, childcare and nursery school 158.8 percent, medical care services 147 percent, housing 111.4 percent. Wages? Up 131.1 percent, barely keeping ahead. Food and beverages? A tame 105.7 percent, not much above the inflation baseline. Meanwhile, blue lines dive: TVs down 98.1 percent, computer software 73 percent, toys 74.2 percent, cellphones 44.1 percent.

America First means unleashing markets, not drowning them in red tape and handouts that jack up costs for hardworking folks. This chart screams why we need to slash the government’s grip before it squeezes us dry.

Decoding the Chart: Winners, Losers, and the Inflation Baseline

This graph tracks percentage price changes for a basket of goods, services, and wages over 25 years, with everything starting at zero in 2000. The black line in the middle? That’s overall inflation at 92.6 percent – the average creep in costs across the economy. Anything above it got pricier faster than the norm; below, it got cheaper or barely budged.

The red cluster at the top? Those are the gut-punchers: healthcare and education leading the pack, with housing not far behind. Hospital services tripled in cost, college tuition doubled, textbooks nearly did too. Childcare surged past wages, making it a nightmare for parents trying to work. Housing outpaced inflation by nearly 20 points, turning the American Dream into a debt trap. Food hung close to the line, up just 13 points over inflation – no runaway there.

Flip to the blues: New cars up a measly 25.8 percent, household stuff 21.4 percent, clothing a pathetic 1.5 percent. Tech? Crashing down – cellphones halved, software and toys down three-quarters, TVs almost free compared to 2000. Wages beat inflation by about 38 points, but that’s cold comfort when essentials eat your gains.

Government’s Heavy Hand: Why Healthcare and Education Are Bleeding You Dry

Where the feds poke, prices explode. Take hospitals and medical care – up 281 percent and 147 percent. An aging population demands more services, sure, but layer on Medicare and Medicaid dictating payments that don’t cover costs, forcing hospitals to hike charges elsewhere. New tech like fancy scans and drugs? Costs soar because regulations slow competition and approvals. Administrative bloat from compliance with endless rules chews up billions – think coding, billing wars with insurers. Consolidation? Hospitals merge under gov blessings, then jack prices in monopoly towns. Drug expenses alone hit 115 billion in 2023, fueled by patent games and slow generics.

College? Tuition up 196.7 percent, textbooks 176.9 percent. Blame federal student loans – trillions guaranteed by taxpayers, letting schools inflate fees knowing Uncle Sam foots the bill. The Bennett hypothesis nails it: more aid means higher prices, as colleges chase prestige with admin armies and amenities. State funding dipped per student, but loans filled the gap, doubling debt loads. From 1995 to 2017, loans ballooned sevenfold after inflation – no coincidence tuition outran everything.

Childcare and nursery school? Up 158.8 percent. Staff ratios, qualification mandates, safety regs – all well-intentioned, but they crush supply. Degrees for caregivers? Costs skyrocket, passed to parents. Subsidies like the Child Care and Development Fund reach only 11 percent of eligible kids, leaving families paying 8 to 19 percent of income. Gaps cost the economy up to 329 billion over a decade in lost work and taxes.

Housing? 111.4 percent spike. Zoning laws, building codes, land-use restrictions – local govs strangle supply, creating shortages of millions of units. Federal mortgage guarantees fueled bubbles, then crashes, but regs on everything from permits to materials keep builders sidelined. Immigration surges demand without matching construction, while subsidies distort markets.

Free Markets Deliver: Tech’s Price Plunge Shows How It’s Done

Contrast that with the blues – where competition reigns, prices crater. TVs down 98.1 percent? Manufacturing efficiencies, global supply chains, cutthroat rivalry from brands flooding the market. Tech advances mean bigger, smarter screens for pennies. Computer software drops 73 percent: Moore’s Law doubles power every two years, slashing costs. Toys 74.2 percent cheaper: Mass production, innovation, no heavy regs.

Cellphones? Down 44.1 percent. Competition explodes features while costs plummet – think how a 2000 flip phone cost hundreds, now smartphones are ubiquitous bargains. New cars and furnishings? Economies of scale, better tech, less intervention keep hikes minimal.

This is capitalism humming: innovation drives quality up, prices down. No bailouts, no mandates – just winners and losers in a fair fight.

Food’s Steady Ride: Not the Villain, Despite the Hype

Food and beverages up 105.7 percent – just 13 points over inflation. Why no explosion? Supply chains absorb shocks from weather, pandemics, wars. Farm subsidies stabilize basics, though they distort too. Tariffs bite sometimes, like on steel cans, but overall, competition from globals keeps it tame. Bird flu, droughts hit eggs or beef, but averages hold. Unlike gov-choked sectors, food’s relative freedom tamps down wild swings.

Time to Drain the Swamp: Cut the Crap and Let Markets Breathe

This chart’s a roadmap to fixing the mess: where government’s boot stomps, costs crush families. America First demands slashing regs, ending loan guarantees that bloat tuition, reforming healthcare payments to spur competition, easing zoning to unleash building. Wages rise when productivity soars, not when handouts hide failures. Food’s proof – less meddling, steadier prices. We’ve waited 25 years for sanity; now’s the time to bulldoze the barriers and put real Americans back in charge of their dollars. No more excuses – let’s make affordability great again.